In the world of fixed-income investing, most people focus on the big numbers: the annual interest rate and the final maturity date. However, there is a “silent” driver of profit that often goes unnoticed by retail investors, yet it is one of the most critical components of your total return.

We are talking about the Coupon Couru (Accrued Interest). In this edition of our analysis, we take a deep dive into how to calculate coupon couru in your cameroon market watch portfolio to ensure you are capturing every franc of interest you’ve earned.

Decoding the “Coupon Couru”: The Hidden Profit in Your Portfolio

When you look at a Cameroon market watch data table, you will see a column titled “Coupon Couru.” While it might look like a minor technical detail, this figure represents the daily “rent” your money earns while it is lent to a government or a corporation. Understanding how to calculate coupon couru in your cameroon market watch portfolio is the difference between a casual saver and a sophisticated investor.

1. What Exactly is “Coupon Couru”?

Bonds typically pay interest (coupons) once or twice a year. For example, the ECMR.10 bond might pay its annual interest every June. But what happens if you buy the bond in December?

From June to December, the bond has been “working” for six months. The interest for those six months has been earned, but not yet paid out. This earned interest is the Coupon Couru.

- The Buyer’s Perspective: When you buy a bond, you must pay the seller the “Clean Price” plus the interest they earned up until the day of the sale.

- The Seller’s Perspective: The Coupon Couru ensures you get paid for every single day you held the bond, even if you sell it before the official payment date.

2. The Step-by-Step Guide: How to Calculate Coupon Couru in Your Cameroon Market Watch Portfolio

Calculating this value manually allows you to verify your brokerage statements and estimate your real-time net worth. The BVMAC generally follows the Act/365 convention for bonds.

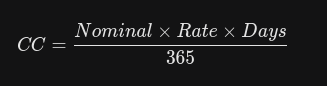

To find your hidden profit, use the following formula:

Where:

- Nominal: The face value of the bond (usually 10,000 CFA in Cameroon).

- Rate: The annual interest rate (e.g., 6.25%).

- Days: The number of days elapsed since the last coupon payment.

Practical Example: Imagine you hold 100 units of a bond with a 6% interest rate, and it has been 180 days since the last payment.

- Annual Interest per bond: 10,000×0.06=600 CFA.

- Daily Interest: 600/365=1.64 CFA.

- Coupon Couru (per unit): 1.64×180=295.20 CFA.

- Total Hidden Profit: 29,520 CFA for your 100 units.

By knowing how to calculate coupon couru in your cameroon market watch portfolio, you can see that even if the market price hasn’t moved, your investment has grown by nearly 30,000 CFA in six months.

3. Why This Data Matters for Your Strategy

The “Clean Price” (the price you see in the ‘Cours de Clôture’ column) does not include the accrued interest. When you are browsing the Cameroon market watch listings, the “Dirty Price”—which is what you actually pay or receive—is the sum of the Closing Price and the Coupon Couru.

- Tax Planning: In many jurisdictions, the Coupon Couru is treated as interest income rather than capital gains.

- Liquidity Management: If you need cash urgently, the Coupon Couru acts as a buffer. Even if the bond market is “NC” (Non-Coté), the value of your accrued interest continues to climb every 24 hours.

- Reinvestment: Seeing a high Coupon Couru (like the 365.48 CFA on some ECMR lines) tells you that a large cash payout is coming soon. This is the perfect time to plan your next move.

4. Common Pitfalls to Avoid

Many beginners make the mistake of ignoring this column and thinking their investment is stagnant. This leads to the “Wait-and-See” trap we discussed previously. In reality, your bond is a “living” asset.

Another error is forgetting the “Ex-Dividend” date. Just like stocks, there is a short window before the payment date where the bond trades without the upcoming coupon. Learning how to calculate coupon couru in your cameroon market watch portfolio helps you avoid buying at the peak “Dirty Price” only to miss the interest payment by a few days.

Final Verdict

The Coupon Couru is the pulse of the fixed-income market. It represents the steady, relentless growth of your capital. By mastering how to calculate coupon couru in your cameroon market watch portfolio, you transform from a passive observer into a data-driven strategist who knows exactly what their portfolio is worth at any given second.